Lumbee Guaranty Bank Reports 2nd Quarter 2022 Earnings

ACCESS Newswire

04 Aug 2022, 00:43 GMT+10

Company reports strong quarterly earnings, asset growth, and continued improvement in asset quality

- $1.24 million in net income for the quarter-ended June 30, 2022.

- 6.0% asset growth, driven by an 8.5% increase in deposits.

- Continued improvement in asset quality.

PEMBROKE, NC / ACCESSWIRE / August 3, 2022 / For the quarter ended June 30, 2022, Lumbee Guaranty Bank ('Lumbee' or 'Bank'), reported net income of $1,236,000, or earnings per share of $0.37, compared to net income of $1,027,000, or earnings per share of $0.30, for the same period in 2021. For the six-month period ended as of the same date, Lumbee reported net income of $2.293 million in 2022, or earnings per share of $0.69, compared to net income of $2.089 million for the six months ended June 30, 2021, or earnings per share of $0.62. The primary causes of the increase in net income compared to prior periods were an increase in deposit service charges on accounts and an increase in other non-interest income due to a Bank Enterprise Award (BEA) grant from the Community Development Financial Institutions Fund.

As of June 30, 2022, Lumbee reported assets of $481.9 million, an increase of 6.0% over assets of $454.6 million as of June 30, 2021. Loans decreased 8.0% to $180.1 million, compared to loans of $195.7 million reported June 30, 2021. Investments rose to $234.5 million from $205.1 million at the year-ago date, an increase of 14.3%. Deposits grew to $437.7 million at June 30, 2022, an increase of 8.5% from June 30, 2021 deposits of $403.5 million. Capital levels remained solid, as shareholders equity totaled $35.3 million, or 7.3% of assets at June 30, 2022, versus $43.8 million, or 9.6% of assets at the year-ago date.

Net interest income totaled $3.51 million in the second quarter of 2022, up 2.8% from $3.41 million in the year-ago quarter. The stability of the interest income was due to a decrease in Paycheck Protection Program fees in 2021 offset by an increase in interest on investments during the second quarter of 2022. Noninterest income was up 58.7% to $808 thousand in 2022's second quarter from $509 thousand in the year-ago quarter, due to increased deposit service charges and the BEA grant previously mentioned. Noninterest expense was $2.91 million in the second quarter of 2022, up 3.4% from $2.81 million in the year-ago quarter. The increased expenses were due to a combination of increased data processing costs and other expenses.

Nonperforming assets ('NPAs') at June 30, 2022, (including nonaccruing loans, loans more than 90 days past due and still accruing, and OREO) were $1.4 million, or 0.30% of total assets, which was down 66% from $4.2 million, or 0.93% of total assets, at June 30, 2021, and down 30% from $2.1 million, or 0.42% of total assets, at March 31, 2022. The allowance for loan losses was $2.0 million, or 1.09% of gross loans, at June 30, 2022, versus $2.3 million, or 1.17% of gross loans, at the year-ago date.

'Our Bank had strong financial results in the second quarter, with earnings exceeding projections again' said Kyle R. Chavis, Chief Executive Officer of Lumbee. 'We were able to grow our loan portfolio by $4.3 million during the quarter, and we continued to attract new deposit customers by focusing on providing value and excellent service. I am particularly proud that our bank was awarded and received a Bank Enterprise Award grant from the Community Development Financial Institutions Fund of the U.S. Treasury. This grant is recognition of the small business lending we have always done in the communities we serve.' Chavis continued, 'As interest rates rise and economic conditions change, we will continue to strive to meet the financial needs of the citizens of southeastern North Carolina and to demonstrate the value of doing business with a community bank.'

Lumbee Guaranty Bank is a community bank headquartered in Pembroke, NC and serves Robeson, Cumberland, and Hoke Counties. Established in 1971, the Bank offers a full array of financial services through its network of fourteen strategically located branch offices over the three-county area. The Bank's common stock is traded on the OTC-QX under the stock symbol LUMB.

###

The information as of and for the quarter ended June 30, 2022, as presented is unaudited. This news release contains forward-looking statements. Actual results may differ materially from those projected, for various reasons, including our ability to manage growth, our limited operating history, substantial changes in financial markets, regulatory changes, changes in interest rates, loss of deposits and loan demand to other savings and financial institutions, and changes in real estate values and the real estate market.

LUMBEE GUARANTY BANK

Statement of Operations (unaudited) Six Months Ended, June 30,

LUMBEE GUARANTY BANK

Statement of Operations (unaudited) Six Months Ended, June 30,

LUMBEE GUARANTY BANK

Statement of Operations (unaudited) Three Months Ended, June 30,

CONTACT:

Kyle R. Chavis, Chief Executive Officer

Lumbee Guaranty Bank

(910) 521-9707; [email protected]; www.lumbeeguarantybank.com

SOURCE: Lumbee Guaranty Bank

View source version on accesswire.com:

https://www.accesswire.com/710772/Lumbee-Guaranty-Bank-Reports-2nd-Quarter-2022-Earnings

Share

Share

Tweet

Tweet

Share

Share

Flip

Flip

Email

Email

Watch latest videos

Subscribe and Follow

Get a daily dose of Maryland Leader news through our daily email, its complimentary and keeps you fully up to date with world and business news as well.

News RELEASES

Publish news of your business, community or sports group, personnel appointments, major event and more by submitting a news release to Maryland Leader.

More InformationInternational

SectionThailand-Cambodia tensions rise as border rules tighten

BANGKOK, Thailand: This week, Thailand implemented land border restrictions, including a ban on tourists traveling to Cambodia, as...

Alliance eyes major military buildup to counter Russia

THE HAGUE, Netherlands: NATO is pressing ahead with a sweeping new defense spending target, calling on all 32 member nations to commit...

Mamdani leads NYC mayoral race in stunning upset over Cuomo

NEW YORK, U.S.: A political newcomer is on the verge of reshaping New York City politics. Zohran Mamdani, a 33-year-old state assemblyman...

Millions endure dangerous US temperatures, heat alert issued

MADISON, Wisconsin: Tens of millions of residents across the Midwest and East Coast faced dangerously high temperatures over the weekend...

Multiple Israeli troops die as armored personnel carrier is blown up in Gaza

KHAN YOUNIS, Gaza - Seven Israeli soldiers were killed in a large explosion in southern Gaza's Khan Younis area on Tuesday night,...

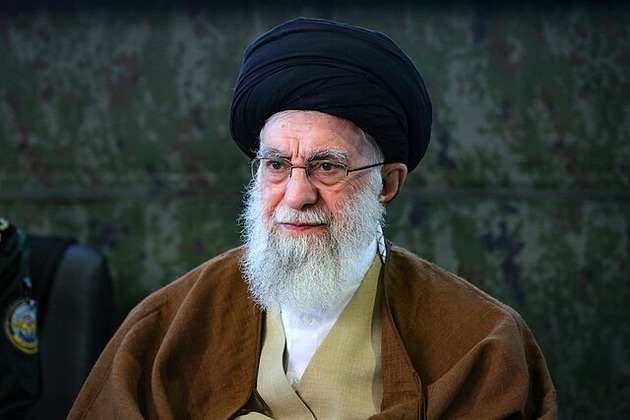

Khamenei remains in hiding as clerics fast-track succession plans

DUBAI, U.A.E.: Iran's top clerics are quietly accelerating succession plans for Supreme Leader Ayatollah Ali Khamenei, who was threatened...

Business

SectionStarbucks refutes media report on plans to exit China

SEATTLE, Washington: U.S. coffee company Starbucks has said it is not planning to sell all of its business in China, even though a...

U.S. markets surge, Dow Jones jumps 404 points

NEW YORK, New York - U.S. stocks surged on Thursday, with Wall Street's major indexes climbing nearly 1 percent as investor optimism...

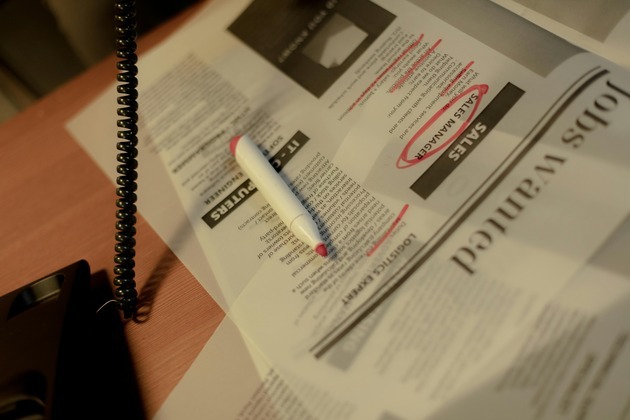

Job board pioneers CareerBuilder, Monster face bankruptcy

NEW YORK, U.S.: Two giants of the early internet job search era—CareerBuilder and Monster—have formally filed for bankruptcy protection,...

Amazon still trails UK grocers on fair supplier treatment

LONDON, U.K.: Amazon has once again been rated the worst major UK grocery retailer by its suppliers when it comes to following fair...

How Chinese vapes reach US stores despite import restrictions

LONDON/NEW YORK/CHICAGO: In suburban Chicago, just 15 minutes from O'Hare International Airport, a small customs brokerage quietly...

Wall Street trades sideway as Mideast tensions subside

NEW YORK, New York, - U.S. stocks were split, but little moved Wednesday after a positive start to the week heralded by a two-day rally....