The Complete Guide to Physician Mortgage Loans

7Newswire

09 Jan 2023, 07:19 GMT+10

If you're a doctor and/or some other type of high-level medical professional, then you may be wondering what your best option is in terms of getting a mortgage loan that fits with your unique financial situation.

The truth of the matter is that physician mortgage loans usually offer the very best opportunities for doctors to actually get a home loan that matches their high income, despite the debt-to-income ratio that can make their application look a bit 'skewed' on paper.

Hey, you deserve to be a homeowner as well. And having some medical school debt shouldn't keep you from doing it.

So in this blog post, you're going to learn how to get a physician's mortgage loan-from step one all the way to the end of the process.

Here's what you need to know.

1. Find A Lender

As with any home-buying process, you generally need to get pre-qualified before you'll want to go shopping for homes.

And this is true when it comes to physician mortgage loans as well.

The good news is that this is a pretty simple process.

You just apply to different lenders who offer physician mortgage loans, tell them a bit about yourself, tell them where you're planning to buy a home, what your degree is in, and how much you want to borrow.

You can also tell them if you plan to put any money down to get started on the process.

The truth of the matter is that no two doctor home loan programs are the same.

So navigating this step can be a little bit complicated.

The good news is that it probably won't take a long time to find out if you qualify.

And once you start talking to some hopeful lenders, you can get more specific about supplying the information they'll need to move you forward in the process.

2. Discuss Your Loan Options With A Loan Officer

Once you've selected a lender, you'll likely be forwarded to a loan officer who'll answer questions about your current position, interest rates for a physician loan, pre-approval, and anything else you may need to know to help you prepare for the mortgage process.

Mortgage home loans are really helpful for young doctors with limited savings and work history-because generally speaking, medical professionals graduate from medical school with pretty high levels of debt.

This can count against you when you're trying to get a conventional mortgage-which makes a physician's mortgage loan super convenient when you have a high income and want to buy a home-and yet, you don't have a fantastic debt-to-income ratio yet.

Some of the benefits of physician mortgage loans are that these loans usually allow for higher debt-to-income ratios, require only employment contracts to demonstrate your income, and have flexible down payment options.

Will You Qualify For A Physician's Mortgage Loan?

The good news is that many different types of doctors and medical professionals can access physician mortgages.

For example, medical doctors, dentists, optometrists, veterinarians, chiropractors, registered pharmacists, and even registered nurses and nurse practitioners can all gain access to physician mortgage loans, as long as they qualify for them.

However, you'll need to go through the beginning of the loan process in order to figure out for sure if you qualify.

If you're struggling to understand the nuts and bolts of how physician mortgage loans work, the best course of action is to find someone in the mortgage loan industry to talk to and have them explain the parts of the loan process that you don't understand.

Sometimes, when you're simply applying for a loan online, it can be a little bit difficult to find answers to the nuanced questions that can pop up.

This is also part of the reason for why it's really important to find a lender that you trust-a mortgage lender who can walk you through the process.

Finding a trusted mortgage lender can really help you to make that leap to getting a physician mortgage loan when qualifying for a conventional loan just doesn't really work with your current situation.

Conclusion

There you have it.

A complete guide to physician mortgage loans, and the basic first steps you need to take to start utilizing this unique type of loan program to help you become a homebuyer.

Even though you're young and fresh out of medical school, you still deserve to be a homeowner as much as anyone else.

So get started today, and see what kind of pre-approval you can get for a physician mortgage loan in your area. Share

Share

Tweet

Tweet

Share

Share

Flip

Flip

Email

Email

Watch latest videos

Subscribe and Follow

Get a daily dose of Maryland Leader news through our daily email, its complimentary and keeps you fully up to date with world and business news as well.

News RELEASES

Publish news of your business, community or sports group, personnel appointments, major event and more by submitting a news release to Maryland Leader.

More InformationInternational

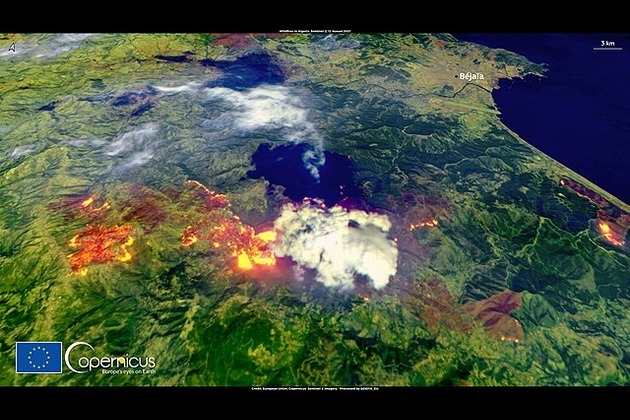

SectionTurkey, France battle wildfires amid early Europe heatwave

ISTANBUL/PARIS/BRUSSELS: As searing temperatures blanket much of Europe, wildfires are erupting and evacuation orders are being issued...

Venetians protest Bezos wedding with march through the town

VENICE, Italy: Over the weekend, hundreds of protesters marched through the narrow streets of Venice to voice their opposition to billionaire...

New French law targets smoking near schools, public spaces

PARIS, France: France is taking stronger steps to reduce smoking. A new health rule announced on Saturday will soon ban smoking in...

Trump hints at DOGE investigation of Musk subsidies

WASHINGTON, DC - U.S. President Donald Trump on Tuesday claimed Elon Musk's success has been built on government subsidies. Without...

Native leaders, activists oppose detention site on Florida wetlands

EVERGLADES, Florida: Over the weekend, a diverse coalition of environmental activists, Native American leaders, and residents gathered...

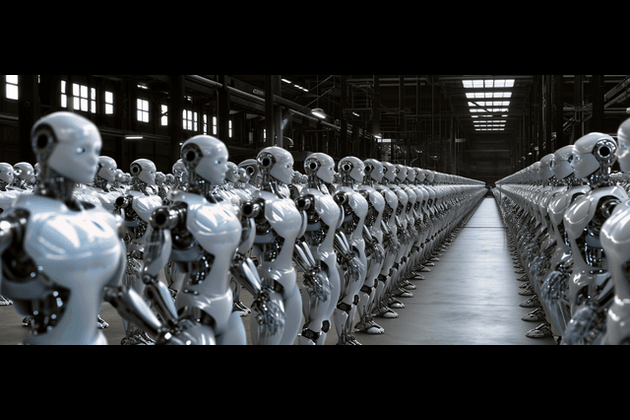

Beijing crowds cheer AI-powered robots over real soccer players

BEIJING, China: China's national soccer team may struggle to stir excitement, but its humanoid robots are drawing cheers — and not...

Business

SectionWall Street diverges, but techs advance Wednesday

NEW YORK, New York - U.S. stocks diverged on Wednesday for the second day in a row. The Standard and Poor's 500 hit a new all-time...

Greenback slides amid tax bill fears, trade deal uncertainty

NEW YORK CITY, New York: The U.S. dollar continues to lose ground, weighed down by growing concerns over Washington's fiscal outlook...

Taliban seeks tourism revival despite safety, rights concerns

KABUL, Afghanistan: Afghanistan, long associated with war and instability, is quietly trying to rebrand itself as a destination for...

Nvidia execs sell $1 billion in stock as AI boom drives record prices

SANTA CLARA, California: Executives at Nvidia have quietly been cashing in on the AI frenzy. According to a report by the Financial...

Tech stocks slide, industrials surge on Wall Street

NEW YORK, New York - Global stock indices closed with divergent performances on Tuesday, as investors weighed corporate earnings, central...

Canada-US trade talks resume after Carney rescinds tech tax

TORONTO, Canada: Canadian Prime Minister Mark Carney announced late on June 29 that trade negotiations with the U.S. have recommenced...